EIN Validation Services

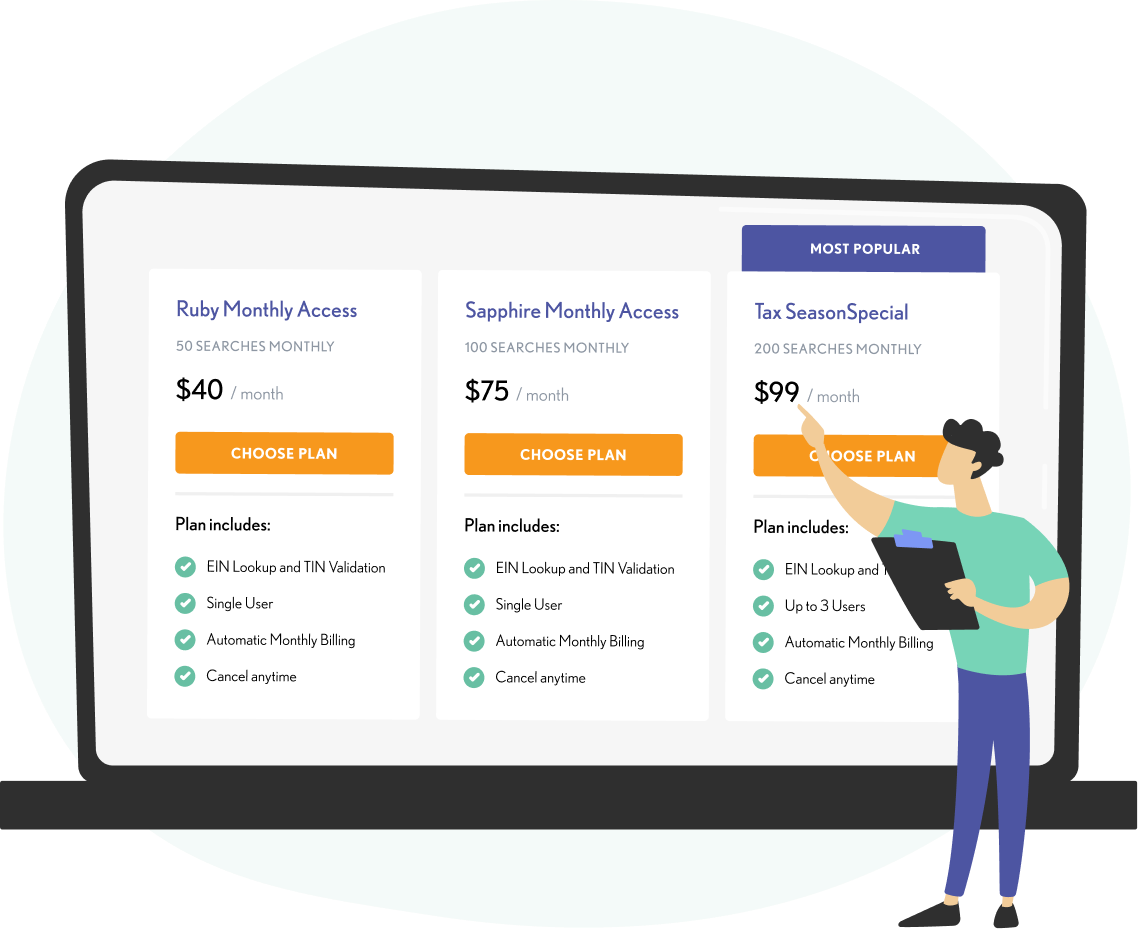

Get started for as little as $25.Avoid Penalties & Fraud with EIN Validation

What is EIN Validation?

EIN validation, or Employer Identification Number validation, is a crucial process that involves verifying the authenticity and accuracy of a business’s unique EIN, a nine-digit identifier issued by the IRS in the United States.

EINs play an essential part in various processes in the financial and accounts payable industries, including things such as hiring staff, filing and reporting taxes, and financial transactions. EIN validation is a fundamental step in preventing fraudulent activities, maintaining compliance with tax regulations, and facilitating secure business interactions. It generally entails cross-referencing the provided EIN and business name with IRS records to confirm its validity and legitimacy.

EIN validation through EINsearch

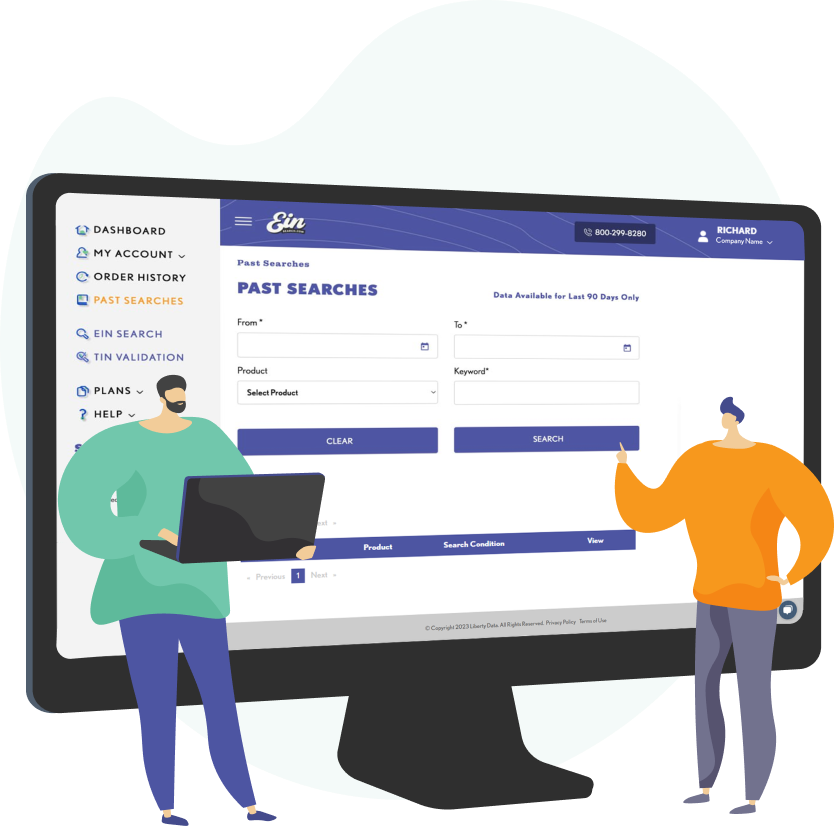

EINsearch provides a suite of services for EIN validation, simplifying the business process. Our real-time EIN validation offers instant and accurate results, enhancing efficiency. The system is built with a user-friendly interface, freeing up your time and expediting your workflow by making it easy to validate EINs.

Whether you’re in the financial or accounts payable sector, our service streamlines all procedures and reduces the opportunity for any errors. EINsearch is dedicated to accuracy and convenience, offering businesses a reliable resource for their financial and administrative operations. It ensures a smooth and dependable EIN validation process, simplifying an essential aspect of business compliance.

Why choose EINsearch for EIN validation?

EINsearch is a highly reliable option for EIN validation, thanks to our strong focus on accuracy, speed, and user-friendliness. With real-time validation, we swiftly deliver dependable results, reducing the risk of errors in financial and legal procedures. Our user-friendly interface streamlines the complex EIN validation process, offering ease and convenience for businesses and organizations verifying their tax identification numbers.

EINsearch’s commitment to precision and efficiency sets us apart, making us a trusted partner for users seeking peace of mind. For EIN validation needs, EINsearch is a dependable choice, catering to the requirements of businesses and organizations with a straightforward approach.

Why your business should use an EIN validation service

EIN validation services confirm a business’s provided Employer Identification Number (EIN) is accurately aligning with official records. This precision is vital for tax, finance, and regulatory compliance, reducing errors and financial blunders.

EIN validation services deter identity theft and fraud. They confirm the EIN’s legitimacy, reducing unauthorized or fraudulent activities in financial and legal transactions and adding an extra layer of security.

EIN validation streamlines operations, enhancing efficiency. It ensures tax law compliance, reducing the risk of fines. Valuable for businesses with frequent EIN verifications, it simplifies complex processes and helps maintain financial order.

“Overall, it’s a good system. If I had to hone in on anything, though, it is its simplicity. That makes it so much easier to train everyone else.”

“They help us validate our new customers when they come onboard. They are fast, easy to work with and provide updates whenever there are any issues with the IRS. Would recommend!”

If you have questions, please call us at 800-299-8280, email us or start a live chat.

FAQs

Why is EIN validation important?

EIN validation is essential for precise 1099 Preparation, tax reporting, secure financial transactions, and regulatory adherence. It minimizes the chances of inaccuracies, fraud, and costly missteps, ensuring businesses operate smoothly within the boundaries of the law and financial integrity.

What happens if an EIN doesn’t validate?

When an EIN doesn’t validate, it signals potential issues or inaccuracies. This might be due to an incorrect number or inconsistencies in official records. To sort things out, further investigation and clarification are necessary to reconcile any differences or errors.

Is EIN validation mandatory?

EIN validation, though not obligatory, is highly encouraged. It’s your wise choice for financial and legal security. It ensures accuracy and compliance, offering a safety net in the complex world of transactions. It’s a safeguard for peace of mind.

How often should EIN validation be performed?

The frequency of EIN validation varies per business. Some do it routinely, while others check when necessary. It’s flexible, allowing businesses to align validation with their specific needs, ensuring they maintain accuracy and compliance in a way that works best for them.

What information is required for EIN validation?

To perform EIN validation, you’ll require the specific EIN and business name and access to an EIN validation tool or service. These tools cross-check your EIN against official records, ensuring accuracy and legitimacy. It’s a straightforward process, an essential step in maintaining financial precision.